Not known Factual Statements About Certified Accountant

Wiki Article

The Best Strategy To Use For Fresno Cpa

Table of ContentsLittle Known Questions About Certified Accountant.The Best Guide To Certified AccountantThe Best Guide To Certified AccountantGetting The Fresno Cpa To WorkAccounting Fresno Fundamentals Explained8 Easy Facts About Certified Accountant ExplainedEverything about Fresno Cpa

The biggest inquiry you should ask on your own, nonetheless, is: What is the finest usage of your time? Even if you do your own accountancy, it's simple to obtain distracted by the several jobs and duties that pester you everyday. As you multitask, there is also the opportunity of making errors along the road, such as a computation error or a missed out on deal.

If all or many of your efforts are used in maintaining up with tracking your costs, other divisions in your service will likely go untreated. Without accurate accounting services, the rest of your service could be negatively affected. Various other difficulties small organizations face can include: As your firm executes its services or generates products for consumers, if you're not maintaining track of your receivables, you may encounter troubles with not earning money for the work you're doing within a prompt manner.

Certified Cpa Things To Know Before You Buy

Sufficient and also timely payroll could be the distinction between working with terrific talent and not taking off in any way. If your company earns money for the job it produces, your staff members expect reciprocatory repayment for the work they're doing to keep the service running. While earning money from your accounts is vital, you also require to preserve a stable circulation to pay back your vendors.When tax period rolls around, you wish to ensure you have one of the most current information on guides for smooth tax obligation prep work. Not just is tracking every cost extremely comprehensive, however you can also end up paying as well much or losing out on handy deductibles. Closing your publications for the year can be daunting knowing that there are many mistakes you can face in the process.

If your books are imprecise, or no person is keeping a close eye on the pay-roll for uniformity as well as transparency, you could run right into scams situations. A monetary audit due to scams is the last thing your company demands. The best and easiest way to fix these usual audit obstacles is by working with an accountant you can depend deal with the information of your finances.

The Only Guide to Accountants

Bookkeepers concentrate mainly on tracking as well as organising economic transactions. They keep total documents of every one of the cash that streams in as well as out of your service. Their records enable accounting professionals to do their work. An accounting professional takes a subjective consider your monetary information and what that can indicate for your company.While the expenses vary, you do finish up saving much more by working with an accounting professional that can execute both tasks required see it here to run your company. As you identify whether you wish to engage an accountant, check out the advantages of employing one. They can help you execute a number of vital jobs for your company such as: Getting your service tax obligations all set and also filed.

Monitoring your capital. Providing advice on tax obligation planning. Creating an economic method. Producing licensed financial accounts and also bookkeeping your business's publications. Accounting professionals help you keep your expenses costs down and can make predictions wherefore's to find financially in your service. From products needed for your office, the office itself, payroll, computer system as well as software application therefore much more, there are a whole host of costs to manage as well as forecast.

See This Report about Fresno Cpa

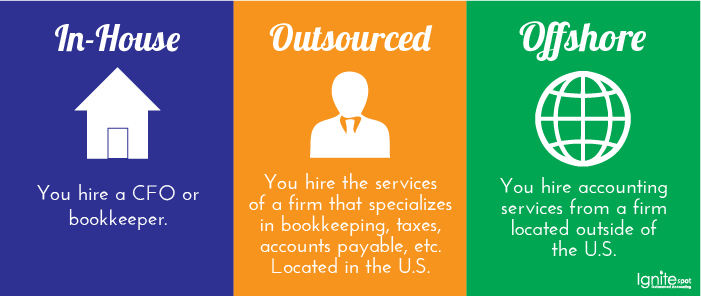

At the end of the month right into freshly fixed up checking account and a fresh set of monetary documents. After your last accounting professional put in their notification. If you observe you might be paying way too much for an in-house accountant. Outsourcing your accountant can help you keep your company agile regardless of what economic or societal adjustments take place around you.

We have all of the know-how you're searching for from payroll to company advancement that can help your company thrive. Focus much more on improving your business through stellar customer support or advertising, as opposed to spending your power on economic information. Call a Wilson Doorperson professional today to begin.

CPAs are try this out accountants that are tax professionals. Prior to you begin your organization, you ought to consult with a certified public accountant for tax recommendations on which service structure will certainly save you cash and also the bookkeeping approach you need to utilize. If you're audited, a certified public accountant can represent you before the IRS.As a tiny business owner, you may find it hard to determine when to outsource obligations or manage them by yourself.

The Only Guide for Fresno Cpa

While you can absolutely deal with the daily accounting on your own especially if you have good audit software application or hire a bookkeeper, there are instances when the proficiency of a certified public accountant can assist you make sound business decisions, stay clear of costly errors and also save you time. Certified public accountants are tax professionals that can submit your service's tax obligations, solution essential financial inquiries and potentially save your this link organization money.They have to take specialist education and learning programs to keep their license, and may lose it if they are convicted of scams, neglect or values violations. In addition, Certified public accountants have limitless representation legal rights to work out with the IRS on your behalf. A CPA is a customized kind of accounting professional with tax know-how who can represent you before the IRS.

If you discover you may be paying too a lot for an internal accountant. Outsourcing your accountant can help you maintain your business agile no matter what financial or societal adjustments happen around you.

Excitement About Certified Cpa

CPAs are accountants who are tax experts. Prior to you start your company, you ought to consult with a certified public accountant for tax recommendations on which organization framework will certainly conserve you cash and also the accounting technique you should utilize. If you're examined, a certified public accountant can represent you prior to the IRS.As a tiny service proprietor, you might discover it tough to gauge when to contract out obligations or handle them by yourself.

CPAs are tax specialists that can file your organization's taxes, answer important economic questions and potentially conserve your company cash.

Getting The Accounting Fresno To Work

They need to take professional education and learning courses to preserve their permit, and may shed it if they are founded guilty of fraudulence, carelessness or values violations. A CPA is a specific kind of accountant with tax proficiency that can represent you prior to the Internal revenue service.Report this wiki page